Household giving is a unique concept to most church management systems. To understand it, it is necessary to understand what is meant by "household". Fellowship One defines a household as the combination of the heads of household (the individuals with the Head and Spouse household member type).

When you are entering contributions—either through the Giving tab or within Fellowship One Contributions—there is an Attributed to drop-down list selection that allows you to choose an individual in the household or to choose the Household option. The Household choice means that the contribution is shared between the heads of household equally.

When performing a merge, you are presented with the question of what to do with household giving. The choices are as follows:

Note: Individual giving is not a consideration in merge cases. Remember that anything that has been attributed to the individual, including contributions, moves with the individual during the merge. In this topic, we are discussing the unique cases of household giving, which has to be purposely selected when entering information and contributions into Fellowship One.

Let's take a look at two case studies to help you understand how these choices will affect contributions after a merge.

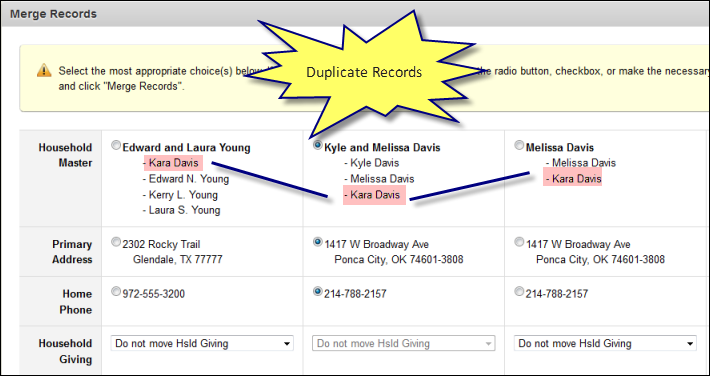

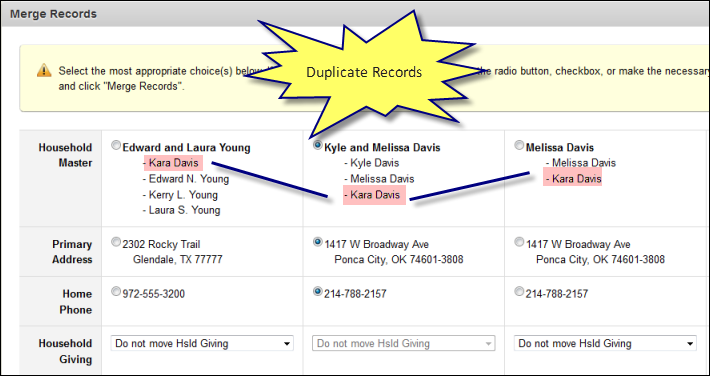

It's common to have duplicate records for kids in your database for a variety of reasons. For example, it's common for kids to come to church with their friends and get checked in as "one-time visitors" via Fellowship One Check-in. If the child's parents begin coming to the church, the child may be entered again as a visitor through Check-in. And finally, when there's a children's event that requires online registration through Fellowship One WebLink, a third record could be created when the parent registers the child for the event.

This scenario means that three different households are affected by merging the child's duplicate records. It's important to make the correct decisions when selecting the radio buttons. As shown in the image below - Kara Davis is the child in question. In the first column, she attended at some point with the Young family. In the second column, her family's information is displayed (this is ultimately where we want her record to reside after the merge is complete), and in the third column, her mother created a new record for both of them by registering for an event online.

The selections made in the Household Giving row are very important in this scenario. In particular, for the first column, we absolutely must choose Do not move Hsld Giving. We do not want to move Edward and Laura Young's household giving in any way.

Since the second column is the destination record, we do not have to worry about the household giving. However, the third column presents us with a choice. We could choose one of the following:

In this case, we are certain that the Melissa Davis in the 3rd column is the same Melissa Davis that is in the Kyle and Melissa Davis household, so it is safe to move the household giving to the household. If you are not certain, the best option would be to select Do not move Hsld giving and wait until you are merging Melissa's record to deal with the household giving.

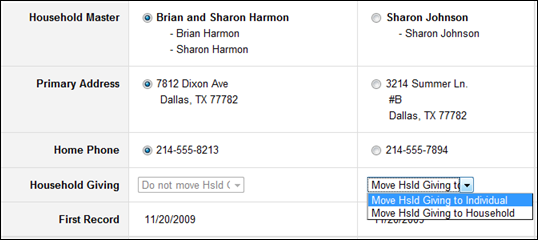

When two singles in the church get married, sometimes the spouse is entered into the husband's household record without realizing that a household record already exists for the spouse. If this happens, you will need to use People > Data Integrity > Merge Individual rather than Duplicate Finder to merge the records.

As shown in the image below, the merge is taking the maiden name record and merging it with the married name record. In the end we want to retain the Brian and Sharon Harmon record and have made all the necessary selections to make this happen.

The household giving option in this case is a little more flexible. It depends upon the desires of the couple in question. Notice that the Do not move Hsld giving is not an option. The reason is because there is only one person in the household in question. We cannot leave the household giving with a household that has no individuals. We must move it. Where we move it is flexible; the following are our choices:

With a newly married couple, it may be best to move the wife's giving to her as an individual during the merge. When you get ready to send out contribution statements you can either send individual statements or household roll-up statements. This is more flexible than to move the wife's giving to the household. For example, if Sharon wants a separate statement, you will have the manual work of finding all of her contributions and editing them to be attributed to her as an individual.